“Since 2000, 52% of Fortune 500 companies have "gone bankrupt, been acquired, or ceased to exist" due to digital disruption, and 75% of S&P companies will be replaced by 2027.” - Harvard Business Review

Increased digital transformation has influenced companies in various aspects including operational efficiency, business models, customer acquisition strategies, etc. Startups with fresh perspectives have been upending industries with new technologies and business models. Innovation or simply digitization for heavy asset industries like the maritime industry has become more than an extra revenue stream but a way to stay ahead of the competition.

According to the research done by Inmarsat and Thetius, COVID has sped up digitization in the maritime industry by 3 years. This trend has also put pressure on more companies to proactively explore new business opportunities at early stages.

There are various strategies that companies in different industries utilize to seek digital transformation. In this article, we will compare three common strategies and see how some of the most well established shipping companies leverage them.

Intrapreneurship

Intrapreneurship = intra-corporate entrepreneurship. It is a strategy where companies seek to develop new ventures or technologies by leveraging their internal employees and resources. According to research done by Sifted, 60% of leading companies have a program that has been running for more than five years. These companies look at 500-1,000 potential projects each year and implement around 5-50 of them.

Pros:

- Employees know the company and industry better than outsiders. Research shows that 82% of employees say they have ideas that could improve the business. This means that it could be easier for internal employees to identify opportunities that have been overlooked.

- Organizations can leverage their existing resources to test and launch the ideas. Once the ideas are validated, they could be integrated into the company’s eco-system faster, hence creating profit earlier.

- Intrapreneurship also introduces an open and more innovative culture to the company.

Cons:

- Less than 1% of the ideas that come out of these programs are useful.

- Most of intrapreneurship projects end up not going anywhere due to the management style.

- Just like entrepreneurship, intrapreneurship has high requirements on the people. Instead of creating intrapreneurs, the innovation program should be designed to find them.

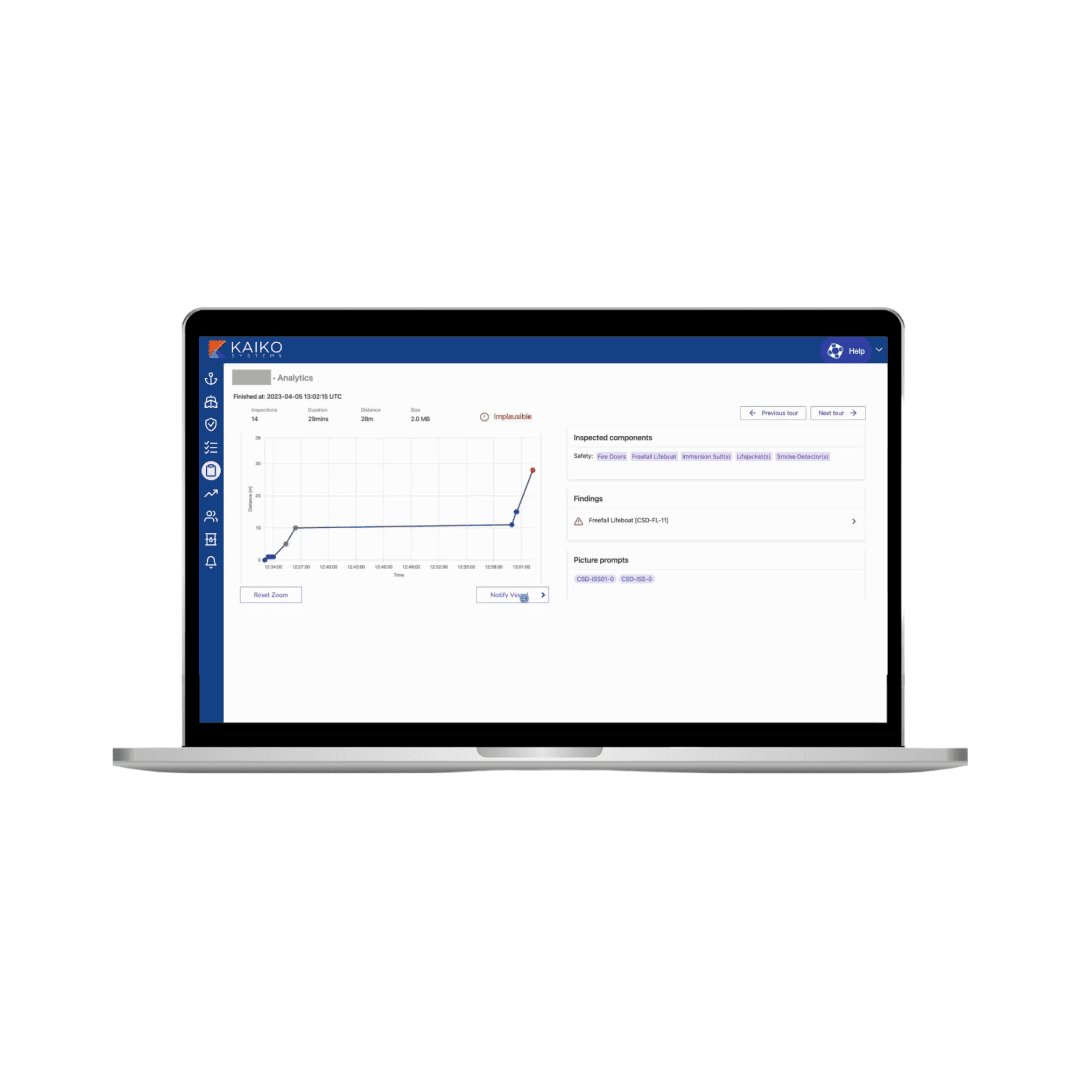

In the maritime industry, leading shipping companies like Hapag Lloyd have set up its Digital Business and Transformation Unit in 2017. It consists of five teams: Product, portal, digital marketing, growth, data insights. The management style appears to be OKR driven. OKR is a goal setting framework that’s created by Andy Grove and now popularly used in various tech giants like Spotify, Airbnb, Linkedin, etc. The Digital Business & Transformation Unit of Hapag Lloyd’s derived intermediate goals from company strategy level and then broken them down into a few key results, which they summarize and check every 90 days.

Accelerator program

A corporate accelerator is a specific form of seed accelerator which is sponsored by an established for-profit corporation. The corporate accelerators serve two purposes: Help entrepreneurs grow its business and feeding the startups into the corporate. Corporate accelerators normally support early-stage startup companies through mentorship, business development introductions, sometimes capital in return for the equity of a startup. There are three types of accelerators: Open innovation programs, external corporate accelerator programs, and innovation outposts.

Open innovation is a strategy where corporates bring tech startups into the company to nurture and scale their products. The selected startups will receive help on engaging their stakeholders, such as potential clients, distributors, suppliers or key strategic players in the sector, so that they can receive feedback and refine their product and offering.

External corporate accelerator is generally a partnership between a corporate and a 3rd party accelerator where the corporate brings in funding and industry-wide connections while the 3rd party accelerators help to scout startups and design a program for the startup to be integrated into the corporates’ strategic plan.

Innovation outposts on the other hand are managed by internal employees. Companies usually set up physical office spaces at places where innovation takes places, like San Francisco, Berlin, Tel Aviv, etc. The primary job of the internal employees at the outposts is to do market analysis and identify new trends. Based on the research and the work of these professionals (which could include interactions and partnerships with local startups), innovation programs then would be introduced into the company’s headquarters.

External corporate accelerator is the most common one in the maritime industry. For instance, Eastern Pacific accelerator has a partnership with Techstars, and Lloyd’s Register partnered with Plug and Play to run its safety accelerator program.

Pros for external corporate accelerators can be that it is easy to get access to startups, and there is less logistics for companies to handle by themselves. On the other hand, since these programs heavily rely on the 3rd party accelerator, the program might lack of industry knowledge and might tend to use one-program fits all strategy.

Corporate venturing

Corporate venturing is a type of VC fund where corporates invest directly in external startups. Corporate venture capital and mergers & acquisitions saw a steep growth trajectory in Q1 2021, nurturing the hypothesis that COVID-19 leads to further acceleration in funding and acquisition due to the increased awareness regarding innovation strategy.

According to research, a corporate VC fund can move faster, more flexibly, and more cheaply than traditional R&D to help a firm respond to changes in technologies and business models. In some cases, such a fund can even help stimulate demand for a company’s own products. On the other hand, the investments may also earn attractive returns. However, running successful corporate VC programs isn’t easy: Companies’ processes and rules can make them slow-footed and unfocused.

On the other hand, corporate-backed startups tend to perform better than normal VC-backed startups.

A typical corporate venture unit in the maritime industry is part of a company that owns and manages vessels. The unit has a focus on early stage technology startups and entrepreneurs in the shipping, logistics and commodities space. Outside of funding, they also connect startups with their global network and give access to their assets.

Conclusion:

- Intrapreneurship requires a different management style. It is a good way to encourage a more innovative culture but the success rate is very low. Compared to teams inside of a corporate, startups are much more driven and works much faster on developing a solution that solves industry-wide problem.

- 3rd party accelerators can open up the corporates to the startup network but it requires iterations for an accelerator program to fit into a specific industry.

- Corporate venturing can move faster than traditional R&D process. It benefits both corporates and startups. However, the VC funds need to have a focus and move fast and decisive.